- graminarthiksewa@gmail.com

- Vijay nagar, Indore

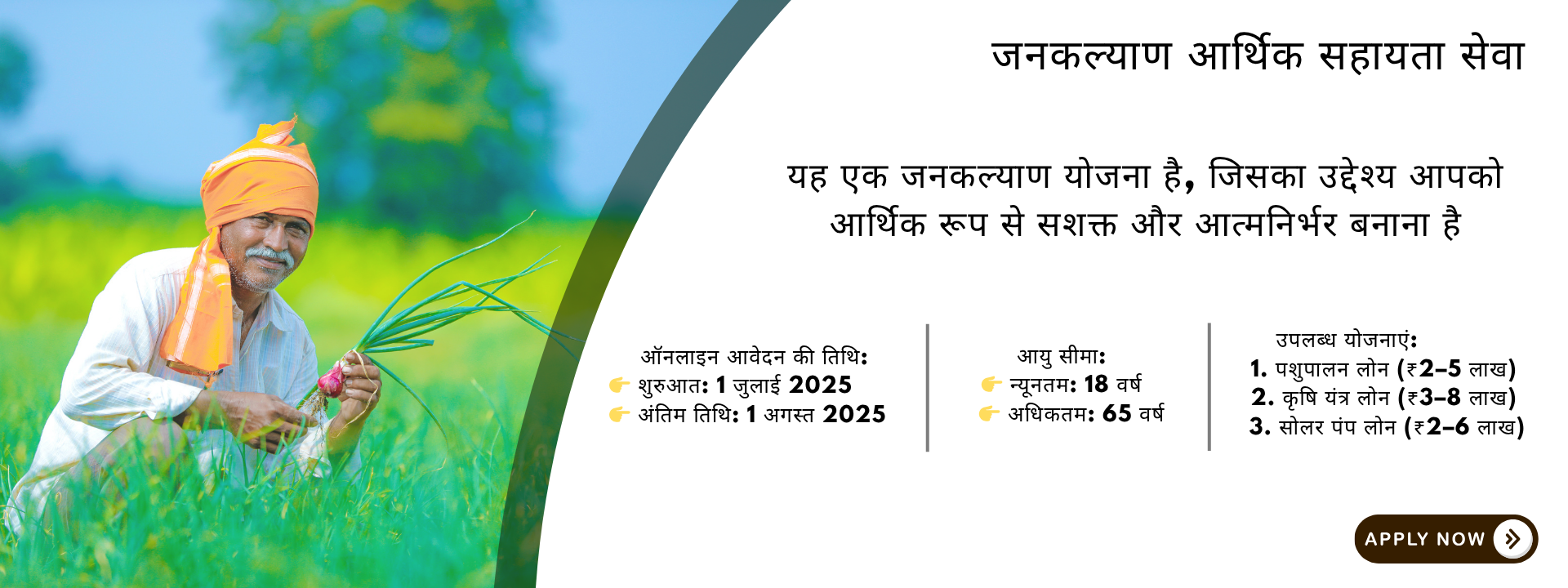

what we offer

"Empowering Rural India with Trusted Financial Support"

At JanKalyan Loan Sewa, we believe that progress begins at the grassroots. Our goal is to support farmers, livestock owners, and rural entrepreneurs by providing easy access to loans and subsidies under Rural-aligned schemes. With a simple process, transparent terms, and expert assistance, we are committed to turning aspirations into reality — one village at a time.

Easy Loans with Subsidy

Get access to low-interest loans supported by up to 30% subsidy designed specifically for rural needs in animal husbandry, agriculture, and solar irrigation.

Approval Based on Eligibility

No complex procedures. If you meet the age and occupation criteria, your application moves forward — fast, simple, and guided.

Up to ₹10 Lakh Assistance

Whether you’re planning a small unit or a larger setup, we support loans from ₹2 to ₹10 lakh, based on your chosen category.

Validated via Security Deposit

Start your application by submitting a minimal, non-refundable security deposit — ensuring only genuine applications move ahead.

Loans

Processed

Subsidy

Disbursed

Applications

Approved

Years of

Service

our priorities

Rural Support That Matters

Farmer-Centric Approach

We design every scheme to meet the real needs of rural farmers and workers.

Simple & Transparent Process

From registration to approval, the entire process is easy to understand and track.

Affordable & Accessible Assistance

Loans are offered with low initial deposits and flexible documentation support.

Loan Categories

Tailored Loan Options for Every Rural Need

We offer a range of loan schemes tailored to support rural livelihoods — from animal husbandry to agricultural machinery and solar irrigation.

Animal Loan

• Amount: ₹2–5 Lakhs

• Security Deposit: ₹3500

• Eligibility Rural Livestock Owner,Age 18-55

• Documents: Aadhaar, Caste (if any), Residence Proof, Bank Passbook

Solar Pump Loan

• Amount: ₹2–6 Lakhs

• Security Deposit: ₹1500

• Eligibility: Irrigation Land Holder without electricity

• Documents: Land Ownership, Farmer ID

Agricultural Equipment Loan (Thresher/Tractor)

• Amount: ₹3–8 Lakhs

• Security Deposit: ₹2000

• Eligibility: Land-holding Farmer

• Documents: Land Record, Aadhaar, Bank Passbook

PersonalLoan

• Amount: ₹50,000–1.5 Lakhs

• Security Deposit: ₹500

• Eligibility: Land-holding Farmer

Age: -18-55

• Documents: Land Record, Aadhaar, Bank Passbook

our priorities

"Why Choose JanKalyan Loan Sewa?"

Trusted Rural Partner

Years of dedicated service in rural development. Helping thousands access genuine financial support.

Expert Assistance

End-to-end guidance on loan application and documents. No agent hassle — clear, simple steps for all.

Village-to-Village Reach

Our platform is made for remote rural users. Connecting every village to financial help.

Transparent Process

No hidden fees, false promises, or confusion. Everything explained clearly before you apply.

Digital Accessibility

Apply online from your phone — anytime, anywhere. Track your status easily through digital channels.

Subsidy-Based Schemes

Up to 30% subsidy for eligible applicants. We process everything as per official norms.

portfolio

Our Latest Case Studies

testimonials

What People Say About Us

"I applied for a livestock loan through JanKalyan Loan Sewa, and within weeks I had the funds to buy two buffaloes. The process was easy and transparent, and the subsidy helped reduce my burden. Today, I earn double what I used to."

"Earlier, my farm suffered due to irregular electricity. After getting a solar pump loan, my irrigation is running smoothly. The team guided me at every step, and I received timely updates and full support."

"As a new-age farmer, I wanted to buy a thresher but didn’t know where to start. JanKalyan made it possible with their simple online form and quick approval. The EMI is affordable, and I’m now helping others in my village too!"

our blog